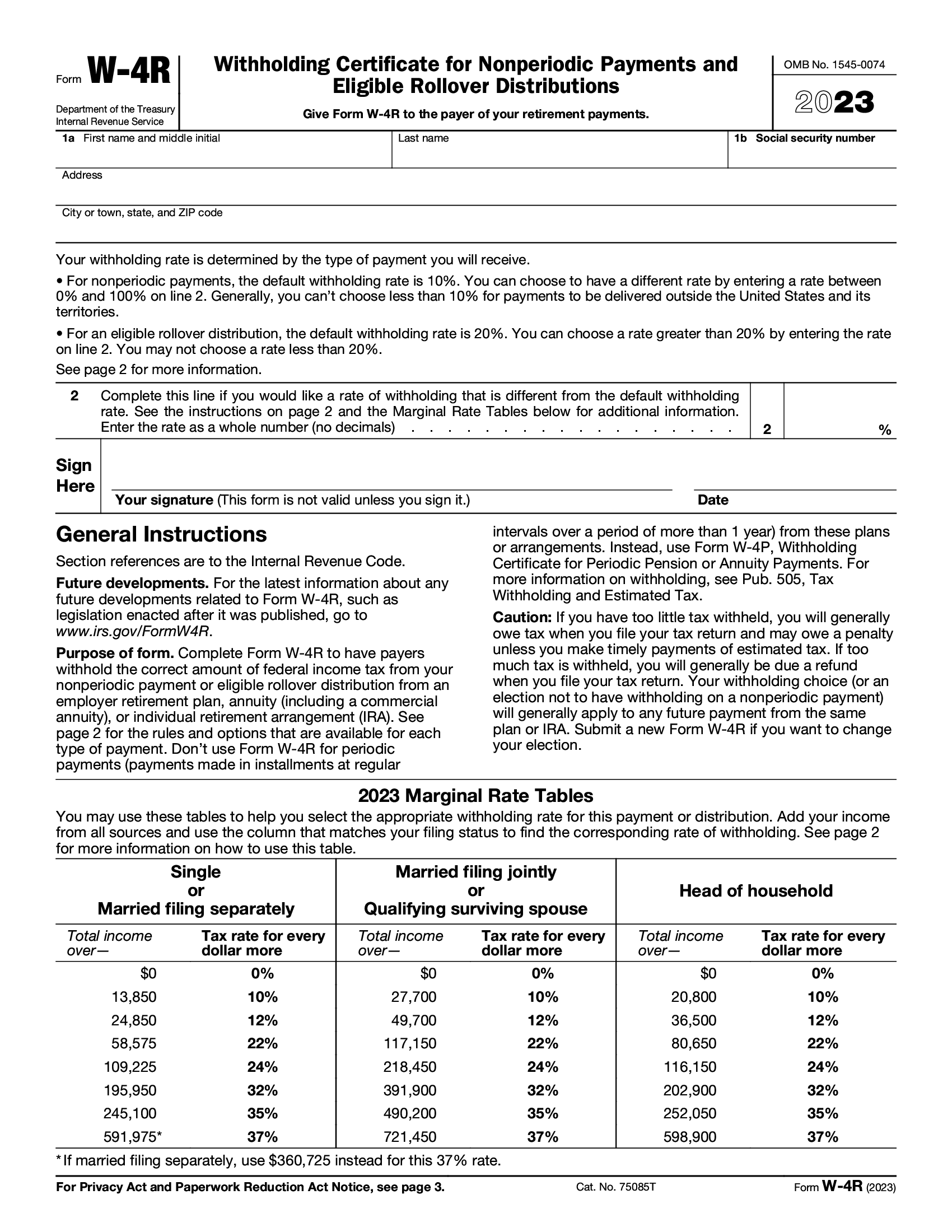

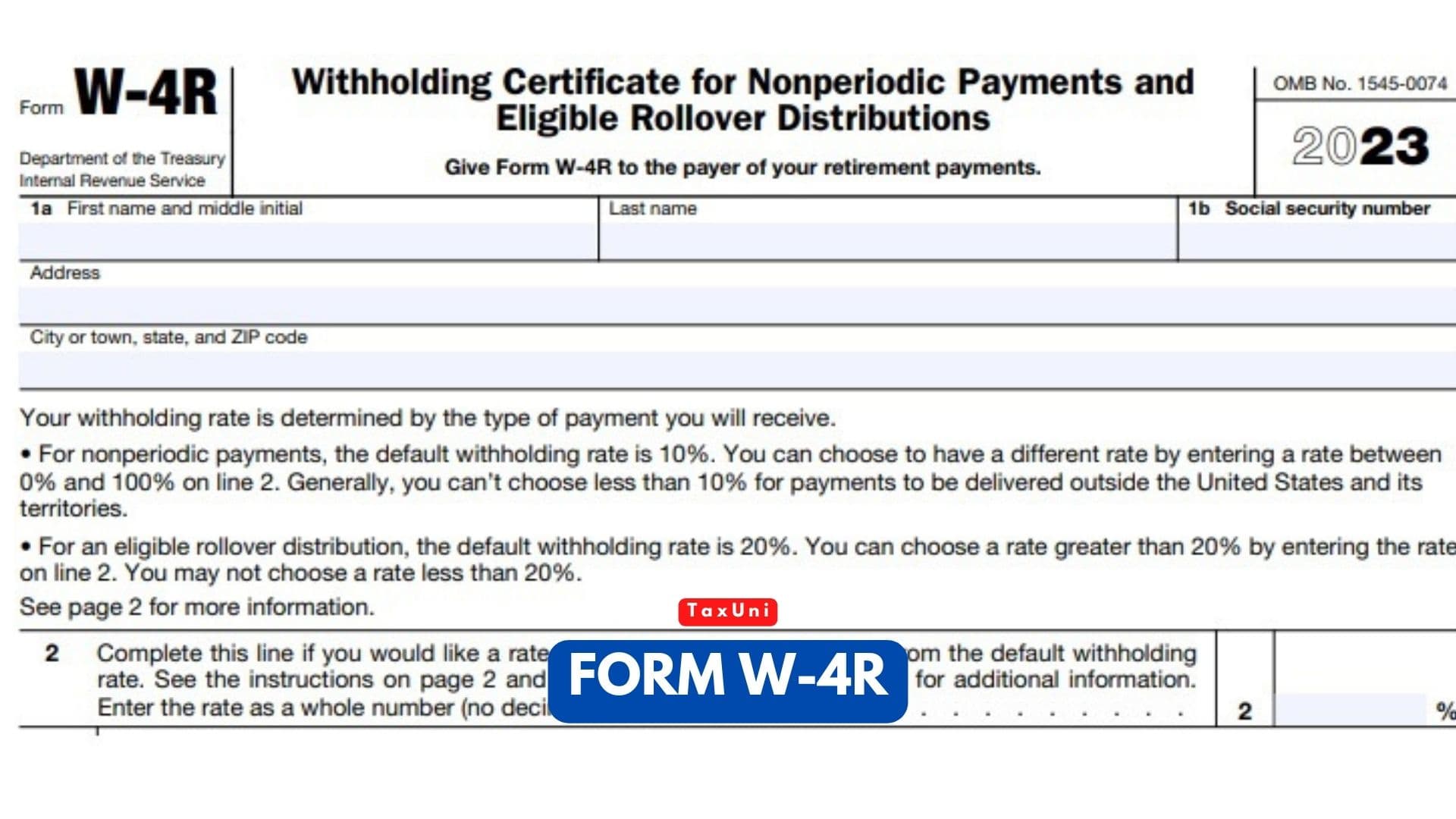

Irs Form W-4r 2025 - Form W4R 2025 2025, By default the payer will withhold 10% of a nonperiodic withdrawal and send it to the irs to go towards federal income tax. The 2025 withholding certificate for nonperiodic retirement payments. These forms will be mandatory starting january 1, 2025.

Form W4R 2025 2025, By default the payer will withhold 10% of a nonperiodic withdrawal and send it to the irs to go towards federal income tax. The 2025 withholding certificate for nonperiodic retirement payments.

Irs Form W4r 2025 Printable Eirena Rayshell, All three drafts have placeholder values,. It allows recipients of nonperiodic payments and eligible rollover distributions to.

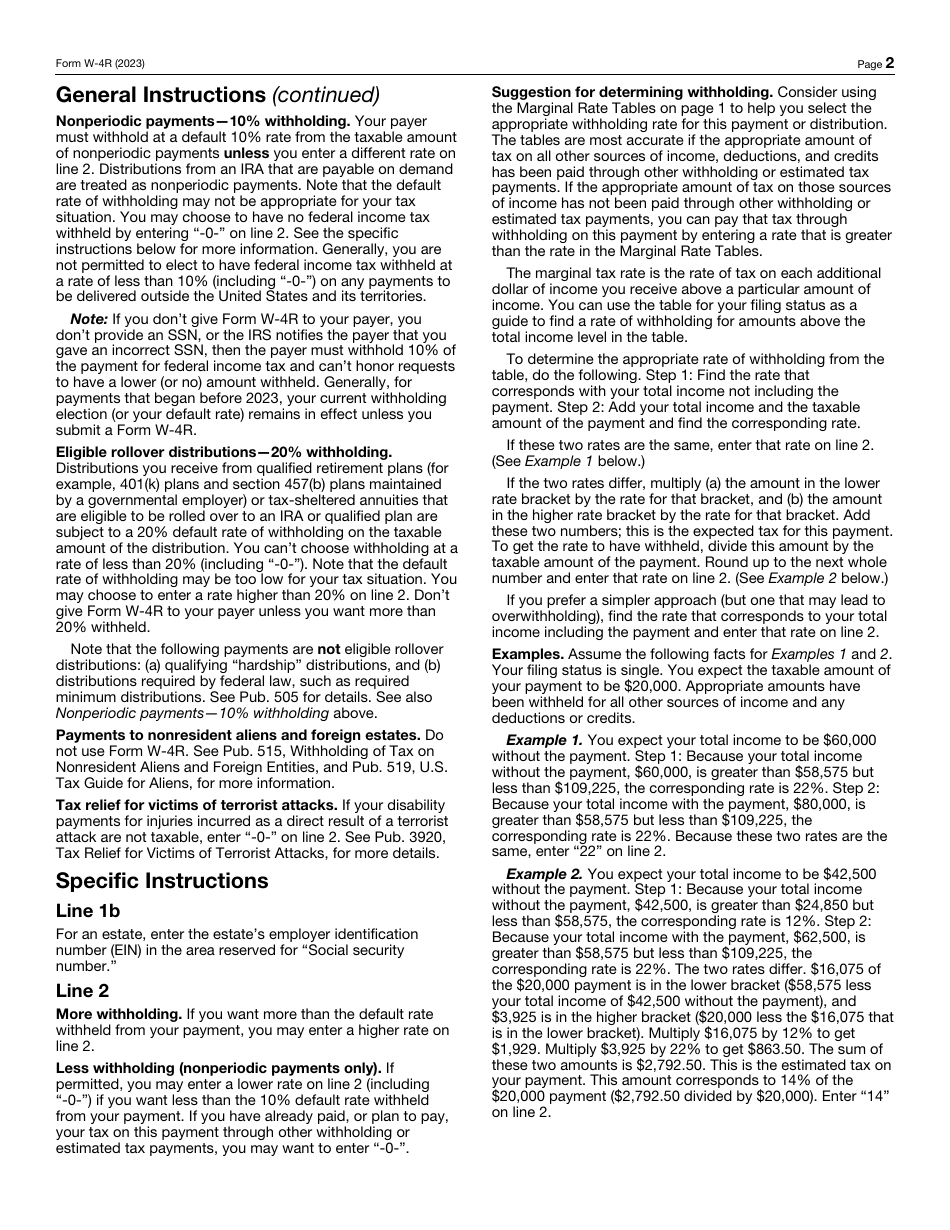

IRS Form W4R Download Fillable PDF or Fill Online Withholding, With its annual updates and enhanced. In addition to minor wording changes, the marginal rate tables.

:max_bytes(150000):strip_icc()/W4eng-b237d0a065e642b1abdba0fa653d8c1b.jpg)

IRS Form W4R. Withholding Certificate for Nonperiodic Payments and, Employees and payees may now use. Streamlining pension and annuity withholding.

Irs Form W-4r 2025. With its annual updates and enhanced. These forms will be mandatory starting january 1, 2025.

IRS Releases Form W4R for 2025 Distributions and Withholdings, If you work at a company that pays out nonperiodic payments or eligible rollover distributions from an employer retirement plan, annuity, or individual retirement. These forms will be mandatory starting january 1, 2025.

The 2025 versions of the forms are to be used beginning january 1, 2025.

Irs Form W4r 2025 Printable Eirena Rayshell, In addition to minor wording changes, the marginal rate tables. The 2025 withholding certificate for nonperiodic retirement payments.

IRS Form W4R walkthrough (Withholding Certificate for Nonperiodic, It allows recipients of nonperiodic payments and eligible rollover distributions to. Employees and payees may now use.

IRS Form W4R Download Fillable PDF or Fill Online Withholding, Here are links to articles and videos we've created about other tax forms mentioned in this video or its accompanying article: The 2025 withholding certificate for nonperiodic retirement payments.

All three drafts have placeholder values,. The 2025 versions of the forms are to be used beginning january 1, 2025.

W4 Form Fillable 2025 W4 Forms Zrivo, If you work at a company that pays out nonperiodic payments or eligible rollover distributions from an employer retirement plan, annuity, or individual retirement. The 2025 withholding certificate for nonperiodic retirement payments.

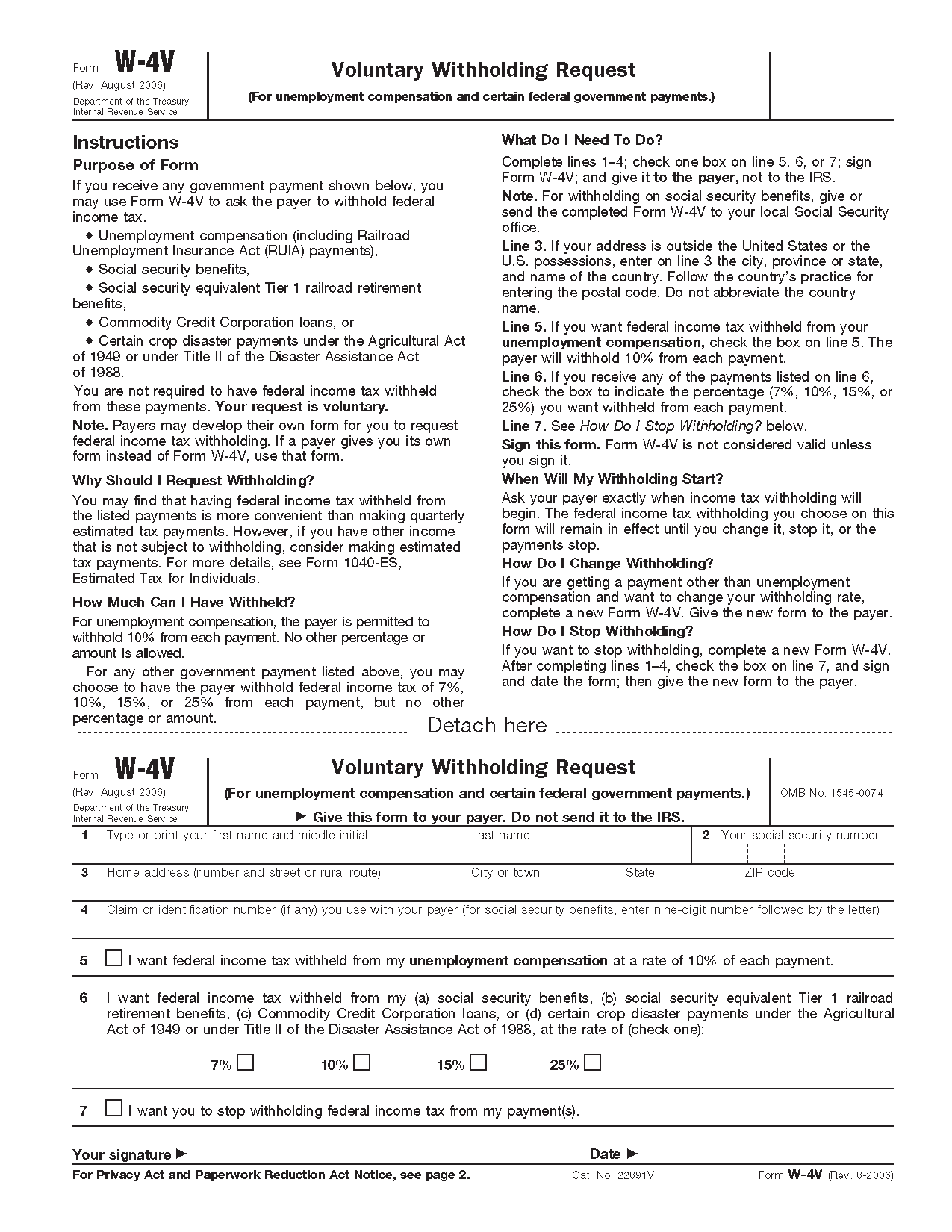

What Is Form W4?, In the meantime, brief scripting specific to three. Employees and payees may now use.

Here are links to articles and videos we've created about other tax forms mentioned in this video or its accompanying article: